In corporate procurement, a common friction point arises when a buyer requests a quote for a quantity significantly below the supplier's stated Minimum Order Quantity (MOQ). The expectation is often a linear price increase—perhaps paying 10% or 20% more per unit. The reality, however, is frequently a price jump of 300% or more, or a flat refusal to quote. This discrepancy is not born of supplier intransigence but of the immutable mathematics of manufacturing: the amortization of fixed setup costs.

To make informed purchasing decisions, procurement professionals must look beyond the visible material and labor costs to understand the "invisible" fixed expenses that precede the production of a single unit. This article dissects the economic structure of custom manufacturing to explain why low-volume customization is inherently expensive and how fixed costs dictate the unit price curve.

The Anatomy of a Unit Price

Every manufactured product's price is composed of two distinct cost categories: variable costs and fixed setup costs. Understanding the ratio between these two is the key to understanding MOQ logic.

Variable Costs are the expenses that scale directly with the number of units produced. If you order 100 bamboo tumblers, the factory needs 100 bamboo blanks, 100 silicone seals, and 100 packaging boxes. Labor for assembly and packing also scales linearly. These costs are relatively stable regardless of order size.

Fixed Setup Costs, conversely, are the one-time expenses incurred to prepare the production line, regardless of whether the run is for 50 units or 5,000. These are binary costs: they exist fully or not at all. They include:

- Tooling and Molds: Creating the physical negatives for injection molding or die-casting.

- Machine Calibration: The downtime and technician labor required to configure CNC machines, laser engravers, or print screens for a specific design.

- Pre-production Sampling: The material and time waste involved in running test units to align registration marks or color match Pantone codes.

- Administrative Overhead: Order processing, artwork proofing, and logistics coordination, which take roughly the same amount of time for a $500 order as for a $50,000 order.

The Mathematics of Amortization

The unit price ($P_{unit}$) is calculated by adding the variable cost per unit ($C_{variable}$) to the total fixed setup costs ($C_{fixed}$) divided by the total quantity ($Q$).

$$ P_{unit} = C_{variable} + \frac{C_{fixed}}{Q} $$

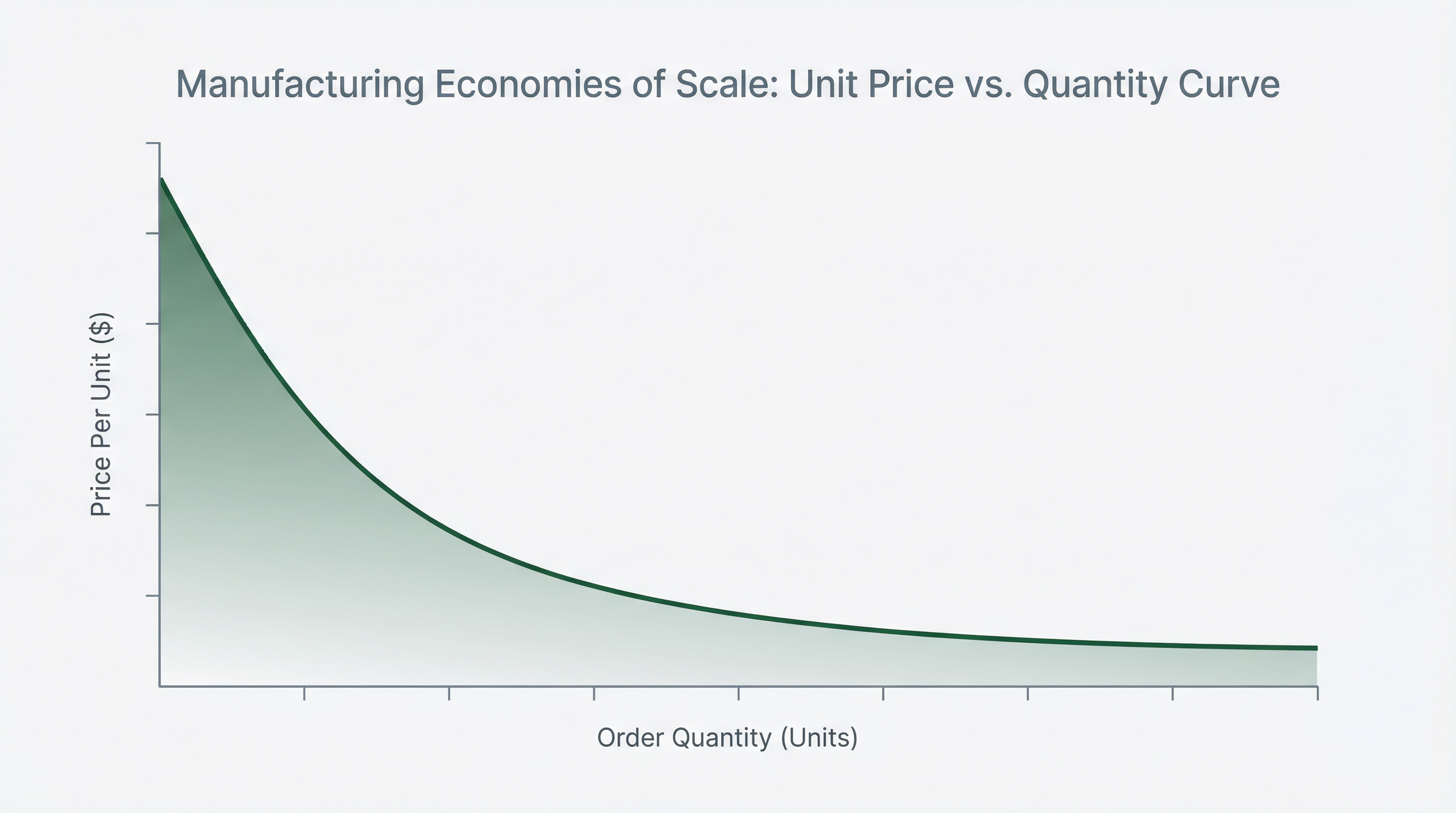

This formula reveals the "Amortization Curve." As the quantity ($Q$) increases, the fixed cost portion ($ rac{C_{fixed}}{Q}$) shrinks rapidly, causing the total unit price to approach the variable cost. However, when $Q$ is small, the fixed cost portion dominates the equation.

Consider a custom-branded silicone mold project:

| Cost Component | Scenario A (50 Units) | Scenario B (500 Units) | Scenario C (5,000 Units) |

|---|---|---|---|

| Fixed Setup (Mold + Calibration) | $2,000 | $2,000 | $2,000 |

| Variable Cost (Material + Labor) | $5.00 / unit | $5.00 / unit | $5.00 / unit |

| Amortized Setup per Unit | $40.00 | $4.00 | $0.40 |

| Total Unit Price | $45.00 | $9.00 | $5.40 |

In Scenario A, the setup cost adds a staggering $40 to the base cost of $5, resulting in a unit price of $45. By increasing the order to 500 units (Scenario B), the unit price drops to $9. The "penalty" for the low volume is not a supplier markup; it is the mathematical necessity of covering the $2,000 setup fee across fewer items.

Why "Just Charge Me the Setup Fee" Often Fails

A common negotiation tactic is to ask the supplier to separate the setup fee, hoping to pay the "bulk" unit price plus a one-time charge. While transparent, this often fails to address the Opportunity Cost of production.

Factories operate on efficiency. A production line that takes 4 hours to set up and run for 1 hour (to produce 50 units) is a line that is losing money. During those 4 hours of setup, the machine is not producing revenue. If the factory has a queue of orders for 5,000 units that would run for 3 days straight after a single setup, prioritizing the small order disrupts the entire production schedule.

Therefore, the "setup cost" in a low-volume quote often includes a premium for Machine Utilization Opportunity Cost—effectively paying the factory for the profit they didn't make by running a larger order during that time slot.

Strategic Implications for Procurement

Understanding this economic reality empowers procurement teams to make better strategic decisions:

1. Consolidate Demand: Instead of ordering 50 custom gifts for ten different departments throughout the year, consolidate the demand into a single annual order of 500. This captures the amortization benefit shown in Scenario B.

2. Standardize Customization: If low volumes are unavoidable, choose customization methods with lower fixed setup costs. Digital UV printing or laser engraving typically requires less setup time and tooling than screen printing or custom molding, making them more cost-effective for smaller batches.

3. Accept "Off-the-Shelf" Compromises: For very small quantities, the most economical choice is often to purchase unbranded stock (where $C_{fixed}$ is zero) and apply generic packaging, rather than forcing a custom manufacturing process that is economically unviable.

For a broader understanding of how these factors influence the minimums set by suppliers, refer to our guide on What Is the Minimum Order Quantity (MOQ) for Customized Corporate Gifts?.

Ultimately, the unit price is not an arbitrary number but a reflection of production efficiency. By aligning procurement strategies with the realities of manufacturing economics, businesses can optimize their spending and build more sustainable supplier partnerships.

Related Articles

The Compliance Barrier: Why a $800 Lab Test Kills Your 500-Unit Order

Why 'Food Contact Safety' isn't just a checkbox—it's a fixed cost that makes small orders financially impossible.

The Shape Premium: Why Custom Molds Demand High Volume

Why requesting a unique product shape triggers a $5,000 tooling fee or a 10,000-unit MOQ, and how to calculate the 'Amortization Break-Even Point'.

Need Professional Corporate Gifting Advice?

From material selection to logo printing and logistics, our team is here to provide expert guidance for your needs.

Contact Us Now